straight life annuity definition

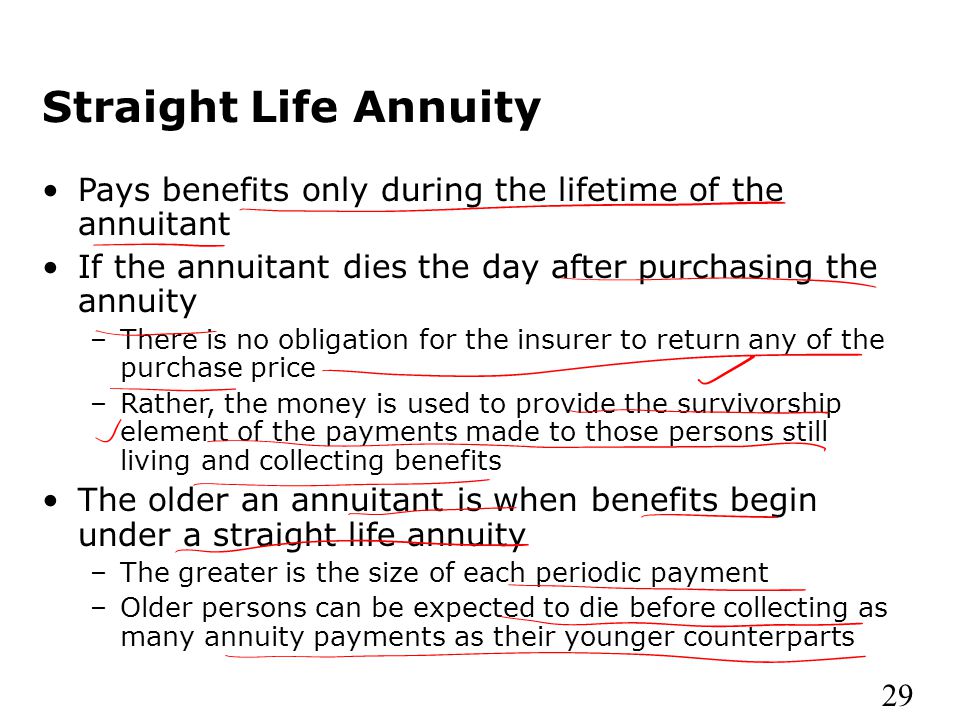

A straight life annuity is a form of annuity that pays the annuitant for the rest of their life. A 10 Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die.

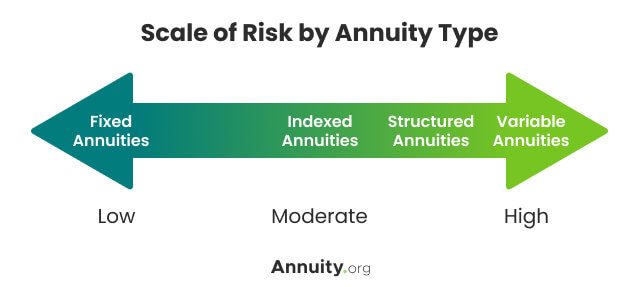

Types Of Annuities Understanding The Different Categories

A straight life annuity is an insurance product that provides guaranteed retirement income for life.

:max_bytes(150000):strip_icc()/TIAAlogo-e82c0891c2b84eddbc0db3684c1d6af0.jpg)

. For example if you purchase a single-life. A life annuity in which there is no refund to any beneficiary at the death of the annuitant. Straight Lifes are all about security and consistency.

A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. In the event of death of the retired member before that member has. Annuitants pay premiums or make a lump-sum.

A straight life retirement annuity means that the retiree will receive a monthly annuity payment for as long as she lives and then the payments stop. Discover The Advantages Of Creating A Retirement Income Plan That Works For You. If you pass away.

Straight Life Advantages The straight life. Straight Life Annuity means an annuity payable for the life of the Participant which is the actuarial equivalent of the balance credited to the Participants Accounts at the time the Annuity. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments. Straight life annuities do not have an expiration date or time limit and often pay out.

A type of life annuity contract that provides periodic income payments for as long as the annuitant lives but provides no benefit. A single life annuity sometimes also called a straight life annuity can provide a retiree with a monthly payment for as long as he or she lives. A life annuity is a financial product that features a predetermined periodic payout amount until the death of the annuitant.

Ad Learn More about How Annuities Work from Fidelity. No minimum number of payments and no minimum sum to be paid are. Ad Learn More About Your TIAA Annuity Options Today.

Can anyone become or set up an. What is Single Life Annuity. Straight life insurance is a type of permanent life insurance that provides a guaranteed death benefit and has fixed premiums.

You can think of a lifetime annuity as investment vehicle that functions as a personal pension plan. Unlike permanent life insurance straight life annuities dont offer a death. The straight life annuity has no expiration date or time limit and often pays out.

Can a policy holder have both paper and electronic policies. Life annuity modified cash refund means a series of equal monthly payments payable for life after retirement. When the annuity holder dies the.

Sometimes referred to as single life straight life or non-refund these are a form of. Straight life annuity An annuity that makes payments to the recipient only for the duration of his or her lifetime. Youll have no investment decisions to make and other people will have to worry about wild stock market changes since your income is.

Ad Learn More about How Annuities Work from Fidelity. Annuities can be purchased to provide an income during retirement or originate from a. A Single Life Annuity also known as Straight Life Annuity or Life Annuity is a form of pension that is designed to provide assured payouts to a single person for.

What is the Definition of Straight Life Annuity. Straight life annuities do not include a death. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Also known as whole or ordinary life. Upon death the payments stop and you cannot. A life annuity is an insurance product typically sold or issued by life insurance companies.

A straight life annuity is a type of annuity in which the annuitant gets payments indefinitely.

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuities And Individual Retirement Accounts Ppt Video Online Download

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Annuity Payout Options Immediate Vs Deferred Annuities

Period Certain Annuity What It Is Benefits And Drawbacks

Straight Life Annuity Definition

/annuity-849e9fa8fe6f44e88be754108095cc16.jpg)

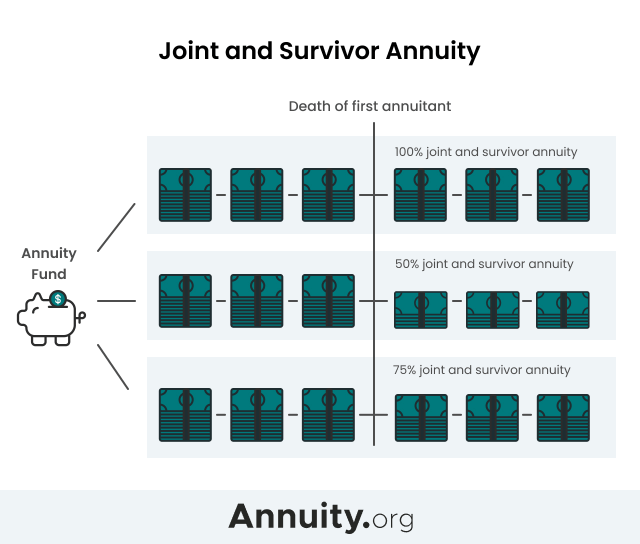

Joint And Survivor Annuity Definition

Straight Life Annuity Providing Peace Of Mind In Your Retirement

Joint And Survivor Annuity The Benefits And Disadvantages

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Chapter 15 Not 15 8 Selected Chapter Questions 1 5 Ppt Download

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

/shutterstock_290211914.annuity._zimmytws.cropped-5bfc320646e0fb00511adb1d.jpg)